Fund Someone’s Dream.

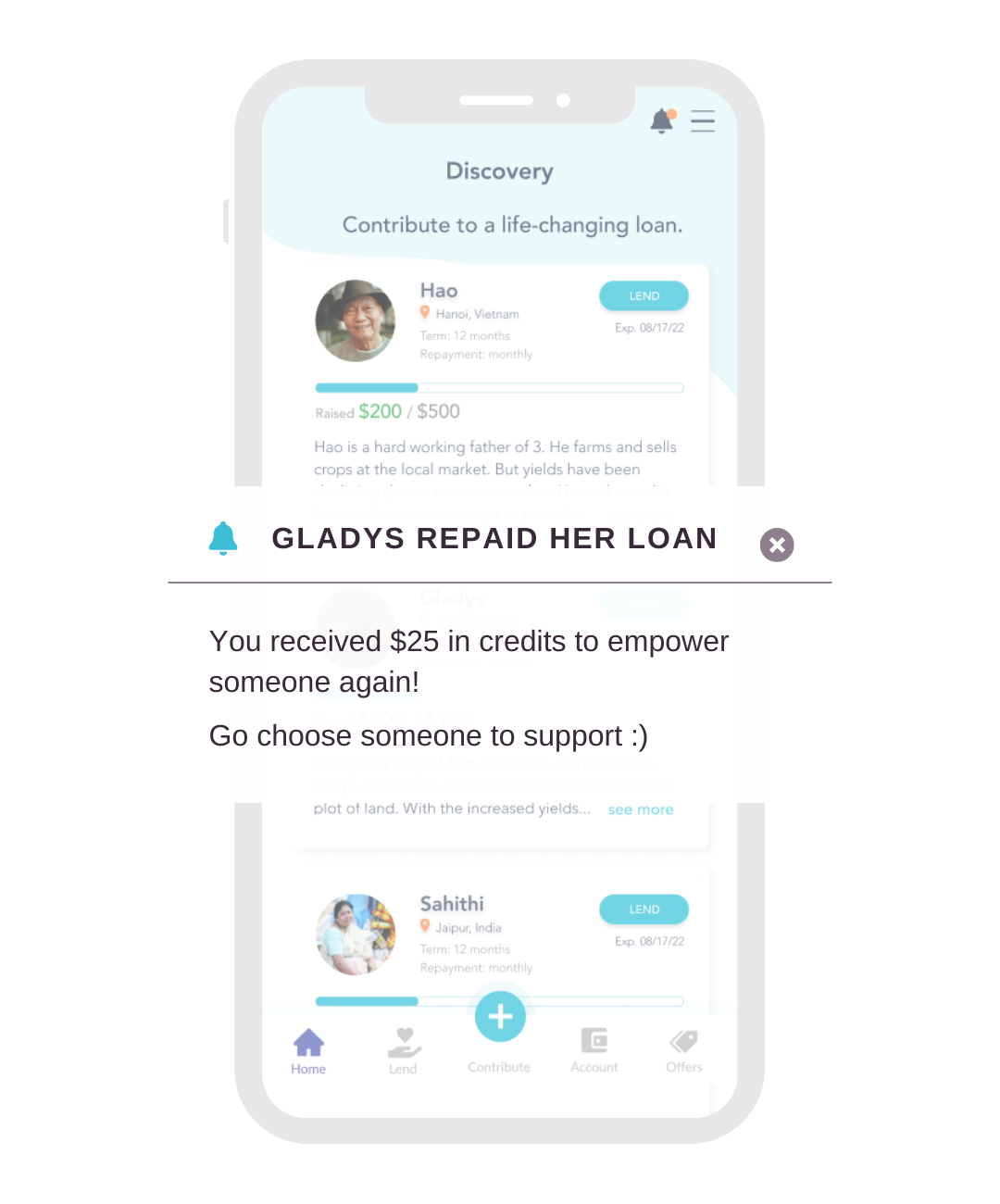

See their story unfold in the ShareChange app.

Give how you want. When you want.

FAQs

According to the World Bank, 1.7 billion people are unbanked — they don’t have access to affordable, ethical financial services like credit or even bank accounts.

✅ Financial inclusion creates access to useful, affordable products — like microcredit, insurance, and savings accounts. This is also called “micro-finance” a concept created by Muhammad Yunis in Bangladesh in the 1970s.

While there may be a long way to go to fully understand the impacts of financial inclusion and microcredit, financial inclusion can be a critical piece of the puzzle for eradicating poverty.

EDUCATION

We believe that education is a critical component of financial inclusion:

- 🏦 Financial literacy workshops

- 🏔 Personal initiative training (developing a growth mindset)

- 🛠 Other business supports

GENDER

Microfinance loans serve almost [20 million people](https://asiasociety.org/education/microfinance-and-women-micro-mystique#:~:text=Worldwide%2C microfinance loans serve almost,payments more reliably than men.) around the world living in poverty. Over 70% of these are women – which is why this form of financial inclusion is so important toward gender equality. On average, the gender gap in bank account ownership between men and women is 9% in low-income countries.

WHAT ARE THE POSSIBILITIES?

Traditionally, we’ve measured impact through a westernized lens. Financial inclusion can have impacts as elusive as improving someone’s self-esteem. Other times, it can change someone’s future entirely, enabling them to improve their business, develop more profits, send their kids to better schools, and even hire others in the community.

Impact Catalysts are the local microfinance organizations working with ShareChange to administer loans and support borrowers in their local communities.

These local organizations are already experts at providing microfinance services in their communities. They offer a range of programs to support borrowers, such as:

- Financial Literacy Training

- Business Training & Support

- Microinsurance & Savings Accounts

- Agricultural Support, such as crop storage and education

When you donate or lend money using your ShareChange app, we send it to one of our Impact Catalyst organization partners who then loans the money directly to borrowers who need it most. For example, the Impact Catalyst loans the money to an entrepreneur (who cannot access financing in another way) to start of grow her business and lift herself and her family out of poverty. As she grows her business, she pays back the loan to the Impact Catalyst and the money is recycled to fund another entrepreneur in need. That is why the amount you donate can cause 10x the impact over time, as it is used over and over again to grow businesses. You will see the impact of your donation or loan on the ShareChange app.

The ShareChange Opportunities Foundation partners 🤝 with organizations who are already experts in providing microcredit in their communities around the world. We focus on those organizations that are making a real impact over time, and have a structure to support micro-entrepreneurs as they grow their own businesses.

Our first partner is Penda Capital, located in Uganda. They provide screening and support to maximize the impact of each loan:

- Verifying borrowers’ identities & business activities

- Providing business training & support

- Restructuring repayment terms if clients face difficulties repaying on schedule

ShareChange seeks to provide as much of the loan to the borrower as possible to make the most impact. To be able to further our mission, we require a 6.5% platform fee 🛠 to cover our administrative costs. While sometimes overhead costs are looked down upon when donating to charities, having a well-funded organization is important so we can make the most impact.

Platform fees go to the ShareChange Opportunities Foundation, mainly to cover payment processing, 🌐 wire transfers, 📲 software fees, and employee compensation. A portion also goes to ShareChange Inc. to improve the product and and reach more people!

Of course, it’s important that social enterprises are prudent and efficient with funds. Still, we believe it’s important to have adequate funding to attract talented, motivated individuals and technology to innovate, and ultimately, maximize our impact. 🦋

Borrowers pay interest to the Impact Catalysts who administer loans and collect repayments in their local communities. From this, ShareChange receives a small fee from the Impact Catalysts to help cover our administrative costs.

Why do Impact Catalysts receive the interest?

Allowing these organizations to collect interest helps local economies to develop self-sufficient, inclusive financial systems!

✅ Our goal is for Impact Catalysts, the microfinance organizations, to become self-sufficient, where they no longer need funds from ShareChange!

Microfinance organizations have high costs when it comes to administering micro-loans. One of the reasons that so many people are financially excluded from traditional systems is the high cost of microfinance services, where people need loans as small as $100.

Providing Microfinance Organizations with funding and allowing them to collect interest helps to support their operational efficiency, meaning they can more quickly scale to:

- Lower their interest rates over time!

- Serve more people in need.

Through the ShareChange app, you can contribute in small increments until you’ve set aside enough to empower someone!

- Contribute as little as $2.50 at a time.

- Lend when you’ve accumulated $25 or more!

You don’t need to fund an entire loan. Multiple people can fund a single loan – and you will receive a proportionate share of the repayments – which you can use to lend to someone else!

Absolutely! You can contribute anytime through Stripe:

If you would like to make a contribution over $1000 or are interested in partnership opportunities, email us at info@sharechange.foundation

It depends on which Impact Catalyst is administering the loan.

- Some will fulfill the remaining amount themselves.

- Others will return the funds so you can choose someone else to lend to. In this case, the client may apply again for a smaller loan!

If an Impact Catalyst’s loans are frequently not funded, we will provide them with additional advice and support to help them succeed!

Some individuals may not be able to repay their loans. Borrowers can run into unexpected challenges, such as health troubles, political instability, lack of demand for their products, or extreme weather and droughts.

👉 If the person you funded can’t repay, you will not receive credits to fund someone else. 96% of loans are repaid on similar platforms.

Not necessarily! You might receive less, depending on many factors, such as:

- Currency exchange rates

- The borrower being unable to repay the full amount they received